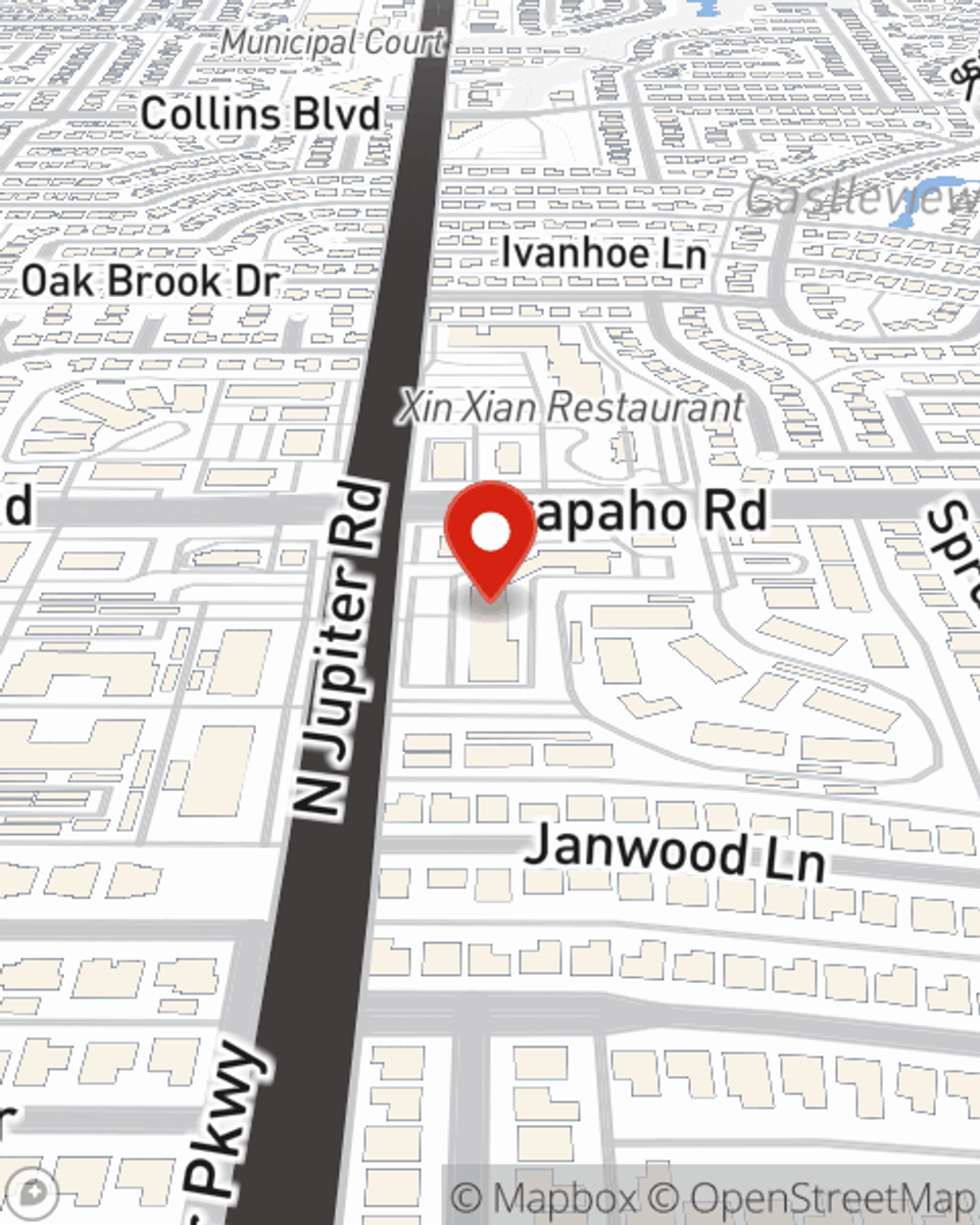

Renters Insurance in and around Garland

Looking for renters insurance in Garland?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Plano

- Sachse

- Rowlett

- Dallas

- Murphy

- Wylie

- Arlington

- Farmersville

- Melissa

- Princeton

- Anna

- Prosper

There’s No Place Like Home

No matter what you're considering as you rent a home - outdoor living space, utilities, number of bedrooms, apartment or house - getting the right insurance can be vital in the event of the unpredictable.

Looking for renters insurance in Garland?

Renters insurance can help protect your belongings

Renters Insurance You Can Count On

When the unexpected abrupt water damage happens to your rented home or townhome, usually it affects your personal belongings, such as a laptop, a set of favorite books or a video game system. That's where your renters insurance comes in. State Farm agent Jim Rosales is passionate about helping you choose the right policy so that you can insure your precious valuables.

It's always a good idea to be prepared. Get in touch with State Farm agent Jim Rosales for help getting started on options for your policy for your rented home.

Have More Questions About Renters Insurance?

Call Jim at (972) 276-2886 or visit our FAQ page.

Simple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Jim Rosales

State Farm® Insurance AgentSimple Insights®

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.